Market Update - November 2025

Resilience, Reality Checks, and Reasons for Optimism

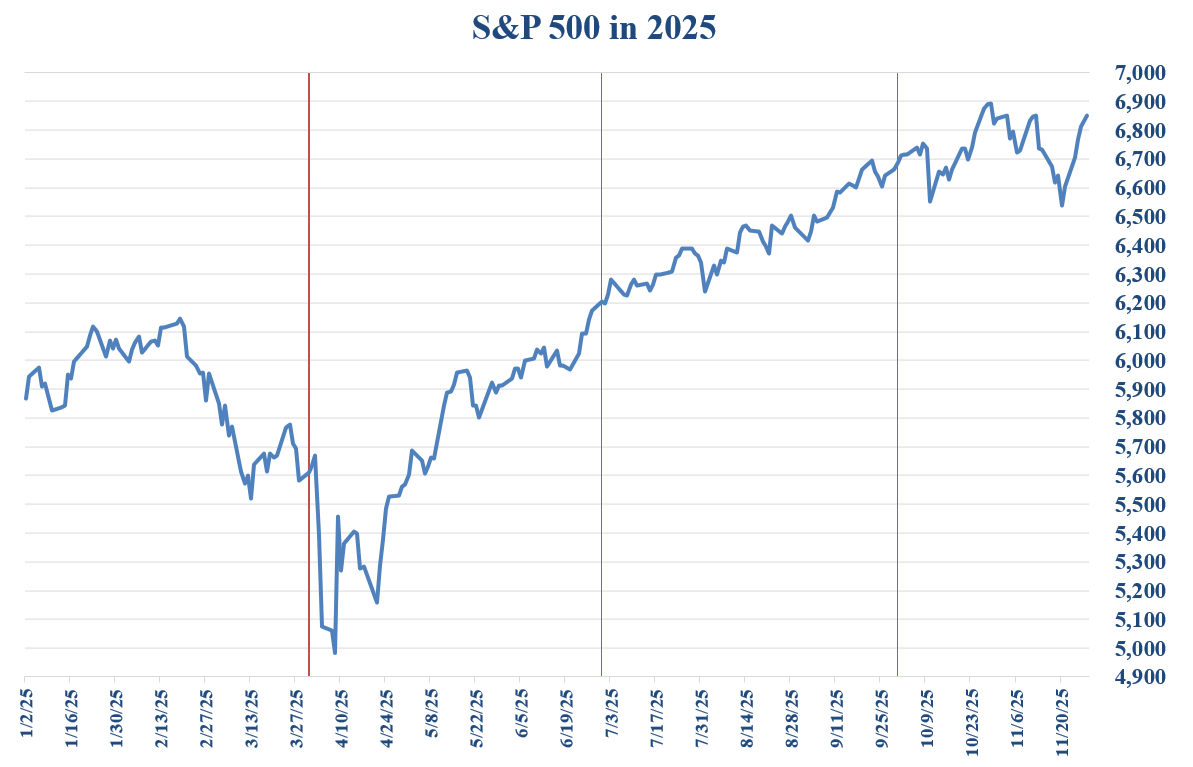

As we close out November, markets continue to balance several crosscurrents: concerns about whether artificial intelligence enthusiasm is overextended, a modest but normal pullback in stocks, and an underlying backdrop of improving inflation, falling interest rates, and a durable bull market. Together, these themes indicate that despite periodic bumps, the market environment remains fairly constructive for long-term investors.

Questions about whether we are experiencing another technology bubble have grown louder as AI-related spending climbs into the trillions. Companies are racing to build data centers, secure GPUs, and invest in research, and in some cases the relationships can seem circular, such as Nvidia’s investment in OpenAI, which in turn is buying Nvidia’s chips.

However, today’s landscape differs materially from the dot-com era. Many of the leading AI companies are hugely-profitable, established businesses with strong balance sheets, in contrast to the money-losing concept companies with no assets which were features of the late ‘90s Tech Bubble. Investors may be overestimating how quickly AI will deliver productivity gains, but that does not mean the technology isn’t transformative. Historic breakthroughs like railroads, electrification, and the internet followed similar patterns: early euphoria, periods of disappointment, yet ultimately, profound long-term economic impact to the world.

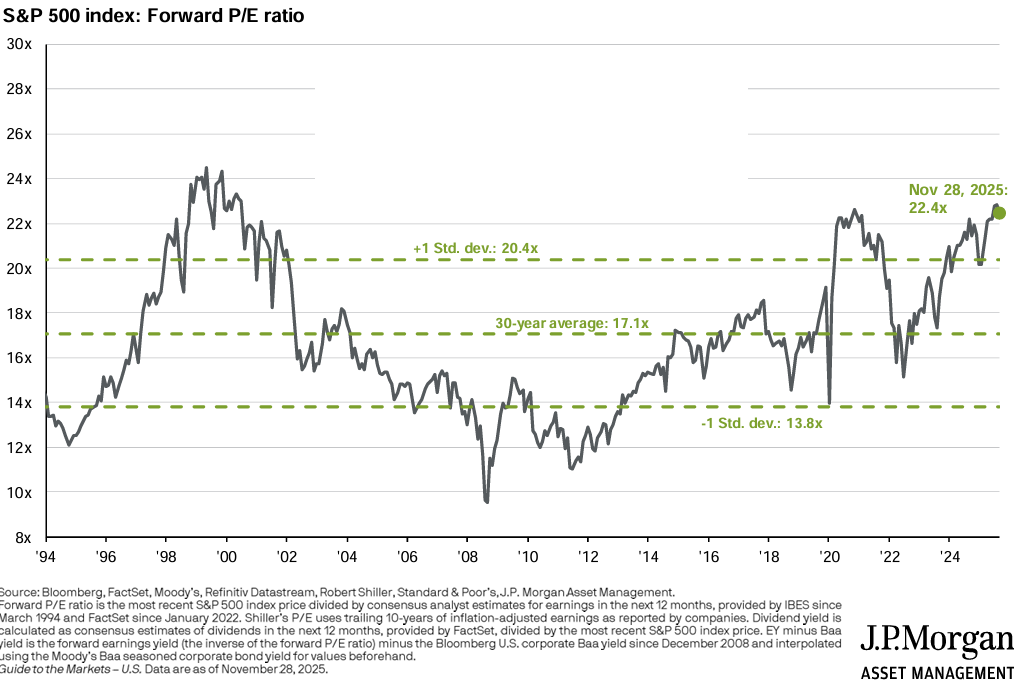

With the S&P 500 trading at roughly 22.4 times earnings, valuations are elevated but not unprecedented. The key for investors is managing concentration risk while still benefiting from innovation, which is exactly what diversified portfolios are designed to do.

While most late November headlines centered on AI stocks, the recent pullback also reflected a broader collection of worries found in typical late-cycle periods. Expectations for another Fed rate cut in December diminished, creating some uncertainty around the path of monetary policy. Investors also worried about the stability of private credit markets, government funding deadlines, tariff announcements, and layoff headlines from large employers.

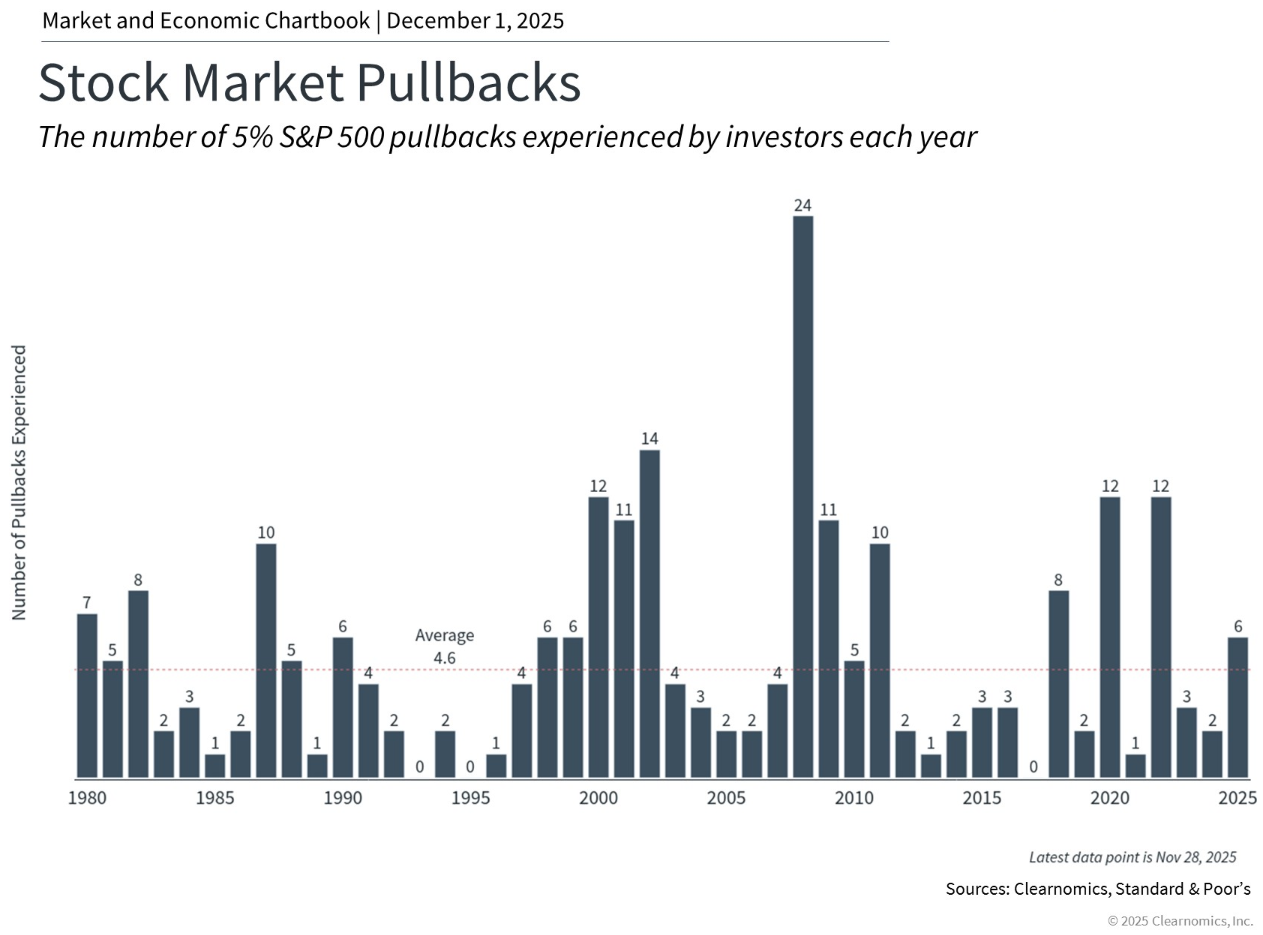

Still, none of these concerns represent new or unexpected threats. Pullbacks of 5% or more occur multiple times in most years, even when annual returns are positive, and this year’s decline fits that historical pattern exactly. After a strong multi-year run, some consolidation is not only normal but healthy.

Under the surface, several key developments remain supportive:

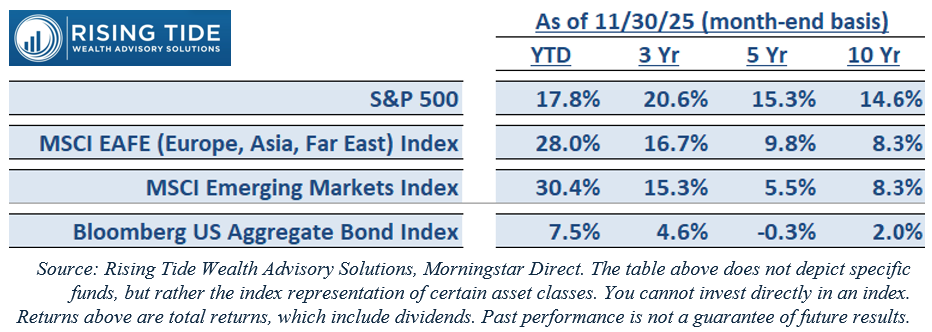

• The S&P 500 has delivered a gain of 17.8% including dividends this year, international stocks have outperformed US stocks for the first time in many years (+28.0% for Developed Markets and +30.4% for Emerging Markets), and bonds have returned 7.5% as interest rates stabilized.

• Inflation has improved and remained stable near 3% on a year-over-year basis.

• With labor markets generally cooling, the Fed now has room to continue easing in 2026 if needed, which historically supports both stocks and bonds.

• Most importantly, the bull market that began in late 2022 is entering its fourth year. Bull markets almost always last longer than bears, often running five to ten years or more, especially when supported by falling interest rates and recovering earnings.

The Bottom Line

Markets are navigating a mix of concerns, including heightened volatility, shifting rate expectations, and recurring political and economic storylines. But the broader backdrop remains constructive. Pullbacks of the size we’ve seen are normal. Inflation continues to stabilize. The Fed has the flexibility to ease further if the labor market softens. And this bull market is still young by historical standards.

For long-term investors, the most effective approach remains the same: stay diversified, maintain discipline, and keep your portfolio aligned with your long-term goals rather than short-term market narratives.