Market Summary 2Q–2025

Navigating Opportunity Amid Uncertainty

The first half of 2025 delivered a reminder that while market headlines feel urgent, the most important decisions require patience and perspective. Surging mega-cap stocks, a pivoting Federal Reserve, sticky inflation, and evolving fiscal policy shaped a complex investment landscape. As we enter the second half, investors should step back to reassess where opportunities and risks are unfolding.

Market Action: A Relatively Narrow, Powerful Rally

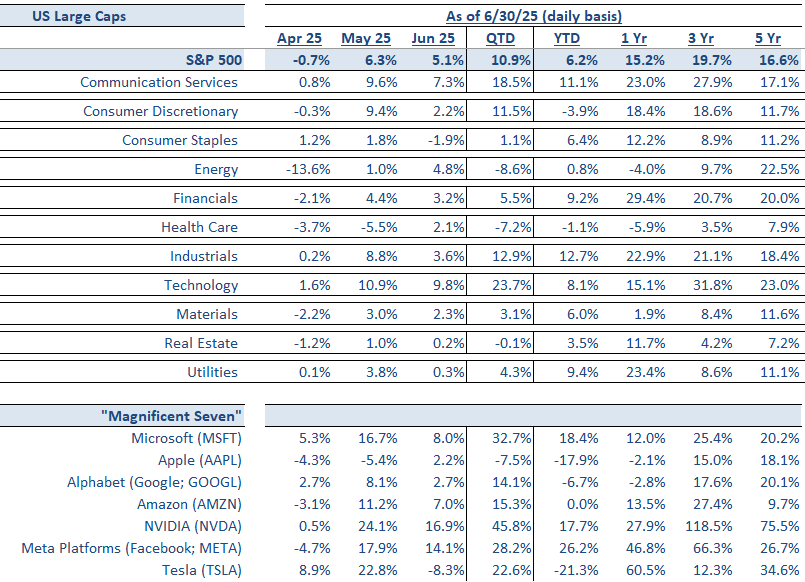

Equities staged a remarkable rebound in the second quarter, with the S&P 500 advancing +11% on a total return (including dividends) basis, again propelled higher by the “Magnificent Seven,” including NVIDIA (+46%), Microsoft (+33%), Meta (+28%), and Tesla (+23%). In contrast, value stocks and small-caps lagged behind. While the Nasdaq and S&P 500 reached record highs, market breadth was relatively thin.

Sector performance revealed clear winners and losers. Technology and Communications rose +24% and +18%, respectively, while Energy (-9%) and Healthcare (-7%) underperformed. The divergence continues to reflect enthusiasm over AI-driven earnings.

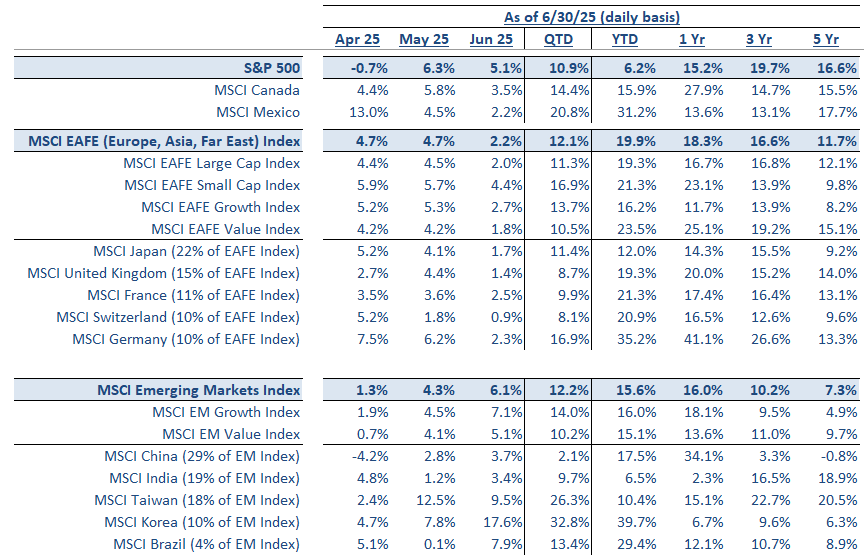

International stocks at large outperformed the US for the second quarter in a row. Both developed and emerging markets were +12% for the quarter. The trade war and the push for more NATO defense spending may be providing the catalyst for a longer-term weaker US dollar trend, which amplifies the benefit of foreign investment from US investors. We suggest investors keep an eye on those trends for further developments.

Bond markets also strengthened as Treasury yields eased from May highs. The 10-year yield settled near 4.2%, supporting gains in both investment-grade and high-yield corporate bonds. Credit spreads remained tight, another sign of investor confidence. The Bloomberg U.S. Aggregate Bond Index returned 1.2% for the quarter, with high-yield bonds outperforming (+3.5%) amid risk-on sentiment.

Alternative assets and commodities told a different story. Gold surged past $3,000/oz, propelled by safe-haven demand and persistent geopolitical concerns. Real estate equities lagged broader equities but remained supported by tight supply and inflation-linked leases. Private credit and infrastructure continued to attract capital as investors sought yield and diversification.

Economic Backdrop: A Slowdown Under the Surface

Beneath the market’s strength, economic momentum has softened. Real consumer spending fell 0.3% in May, and auto sales retreated after an early-year surge driven by pre-tariff buying. Homebuilding has struggled under the weight of high mortgage rates, weak demographics, and rising inventories. Business capital expenditures have been uneven, reflecting uncertainty over trade policy.

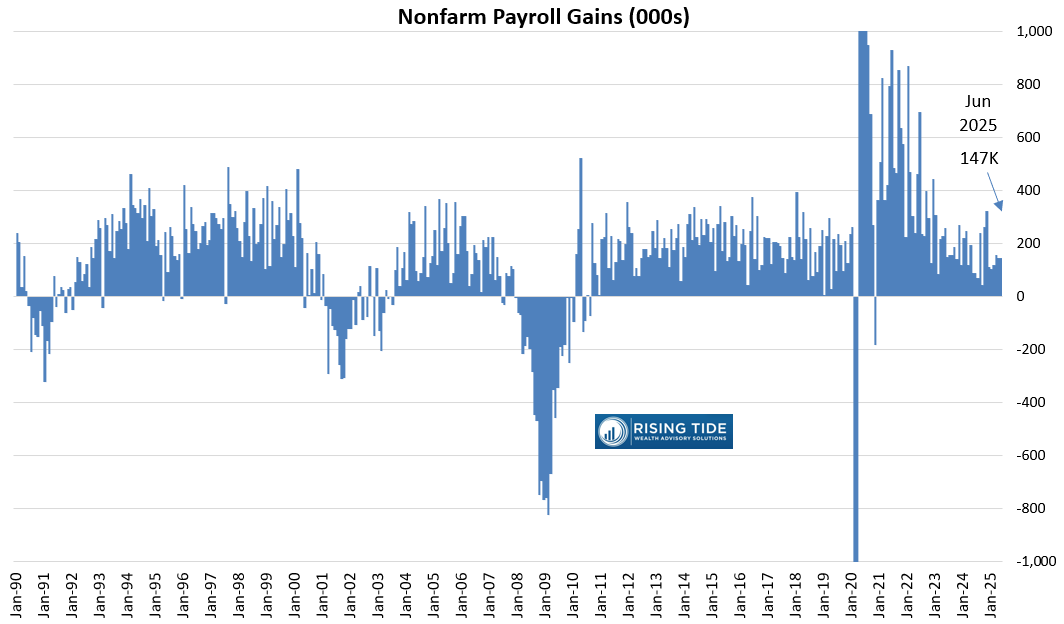

Labor markets remain resilient but are gradually cooling. Nonfarm payrolls through June have averaged 130,000 jobs per month in 2025, down from last year’s pace of 164,000 through the same period, while unemployment has held steady near 4.1%. Continuing jobless claims have edged higher to multi-year highs, in tandem with other signs of softer demand for workers.

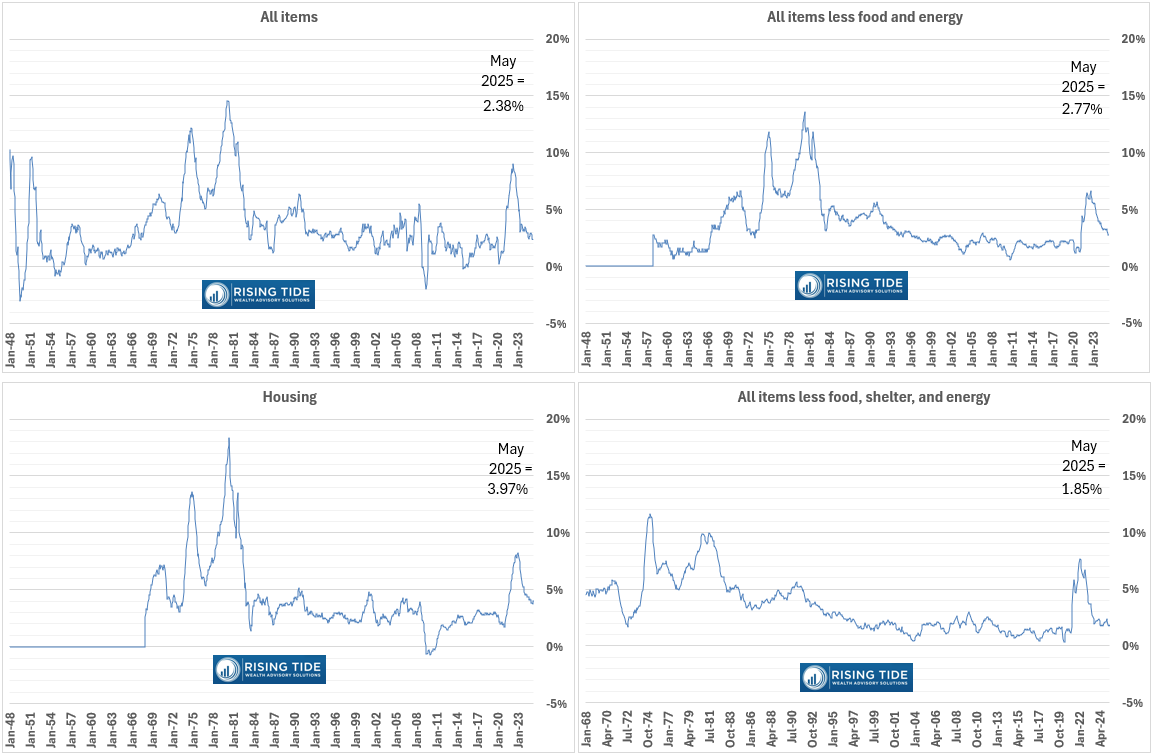

Inflation has eased but remains only slightly above target. The Fed’s preferred PCE deflator registered 2.3% year-over-year in May, while CPI has fallen to 2.4% and “supercore” CPI (excluding notoriously slow-to-fall shelter costs) is at 1.9%. Shelter and services costs continue to run hot, offsetting declines in energy prices. Tariffs are expected to push inflation higher in the second half of the year: J.P. Morgan estimates tariff revenues in June surged to $27 billion, implying an effective tariff rate above 8%, up from 2.5% a year ago.

Policy remains a central theme. The Federal Reserve held rates steady in June but signaled a dovish shift, projecting two 25-basis-point cuts later this year if growth slows further and inflation pressures moderate. Meanwhile, Congress just approved the “One Big Beautiful Bill,” a sweeping fiscal package that combines tax cuts with expanded tariffs. While the package offers short-term tax relief to households, the potential for adding trillions to federal deficits over the next decade could push long-term interest rates higher.

These cross-currents set the stage for what JP Morgan strategists call a “cold, hot, cold” cycle: a cooling economy through late 2025, a brief rebound as tax refunds and spending surge in early 2026, and renewed slowing as fiscal support fades.

What Investors Should Do: Discipline Over Reaction

Against this backdrop of the presently strong markets and a moderating economy, investors face a familiar temptation: chase recent winners or retreat to the sidelines amid uncertainty. History suggests that neither extreme is optimal. Instead, disciplined portfolio management remains the best path to long-term success.

Stay diversified. While U.S. large-cap growth stocks have led returns, valuations remain elevated and leadership has been narrow. International equities, value-oriented stocks, and alternatives offer cheap diversification that can help cushion volatility if leadership rotates.

Avoid market timing. It can be tempting to wait for a “perfect” pullback before investing. Yet data show that markets spend a surprising amount of time at or near all-time highs. Over the past decade, about 15% of trading days were record highs, a reminder that staying invested is often more rewarding than trying to time short-term moves.

Review bond allocations. With Treasury yields still near multi-year highs, fixed income offers more compelling income potential than in years past. High-quality bonds provide ballast against equity volatility, while select credit exposures can enhance yield.

Consider real assets and alternatives. Persistent geopolitical risks, structural shifts in energy demand, and evolving inflation dynamics argue for including alternatives assets which can provide diversification with uncorrelated returns.

Revisit risk tolerance and goals. The past six months underscored how quickly markets can swing between fear and euphoria. A portfolio aligned with your long-term objectives and risk capacity will be better equipped to weather the next phase, whether it brings renewed growth or a more protracted slowdown.

The bottom line:

2025 has so far demonstrated the paradox of investing: that the most important actions are often the least urgent. Rather than reacting to every headline or market record, successful investors focus on maintaining diversified, disciplined portfolios built to endure the unpredictable. As the second half unfolds, this mindset remains the surest path to achieving long-term goals.